Balancing the scale: An open discussion on the cost of new nuclear

- WePlanet Australia

- Mar 26, 2024

- 14 min read

On 9 March WePlanet Australia published a blog post (‘Thumb on the Scale’) written by Oscar Archer.

Energy commentator Simon Holmes à Court contacted us privately on 16 March expressing some concerns with the content. We asked him for detail and he put together a document setting it out. While it was intended to be private communications, he agreed for it to be published as a guest post here.

WePlanet Australia is committed to open and robust discussion to shape evidence-based policy that can bring about the best outcomes for people and the environment.

In the article that follows:

Text from the original article appears like this.

And Simon's responses appear like this.

Thumb on the Scale Towards the end of 2023 the pioneering US Small Modular Reactor company NuScale Power abandoned its first project in Idaho, chiefly due to cost overruns. In Australia, this was apparently viewed as too good of an opportunity to waste.

Technically the NuScale/UAMPS Carbon Free Power Project (CFPP) project was cancelled because NuScale failed to secure sufficient subscriptions to proceed. From mid-2020 through to late 2023 subscriptions hovered around 20–25%. In early 2023 the burden for securing sufficient subscriptions transferred from the CFPP to NuScale (due to a renegotiation of the Development Cost Reimbursement Agreement). NuScale failed to secure significant new subscriptions over the year.

It would be fair to say that new subscriptions were difficult to secure due to escalating costs. In addition CFPP members were advised in early 2023 that the project was failing the Economic Competitiveness Test (ECT), with a project LCoE ‘over’ US$160/MWh, or A$246/MWh, which would have given CFPP members the right to cancel at the next DCRA ‘off-ramp’. NuScale committed to work diligently through 2023 to bring down the cost.

NuScale was due to reveal the latest round of cost estimates (Class 2) in January 2024. By cancelling the DCRA by mutual agreement before the January 2024 offramp, NuScale handily avoided publicly revealing the revised costs. It’s fair to suppose that costs had increased since January 2023. It’s also fair to note that there were many challenges with the UAMPS project site at INL — transport logistics and availability of water and workforce.

CSIRO is using the total construction cost estimate (including owner’s costs) from January 2023, not the unpublished — and likely higher — estimates prior to project cancellation.

(I have studied hundreds of NuScale documents and dozens of presentations related to the CFPP and published detailed threads on twitter.)

Wind the clock back to 2019, when the CCO of NuScale Power submitted clarification to the federal Standing Committee on the Environment and Energy, as well as the CSIRO and AEMO, that his company’s rigorous cost estimate for the SMR design they were working to deploy was AUD$5,248 per kilowatt (kW) at the prevailing exchange rate. $5,248 per kW is a measure of “Overnight Capital Cost” or “Overnight Construction Cost”. As summarised recently by Dominon Engineering, Inc for the state of Virginia in the US:

While project financiers, Lazard, CSIRO and many (most?) analysts use this definition of OCC, it is not uncommon for vendors to leave out owner’s costs, contingencies and profits (which NuScale calls “fees”) in published OCC.

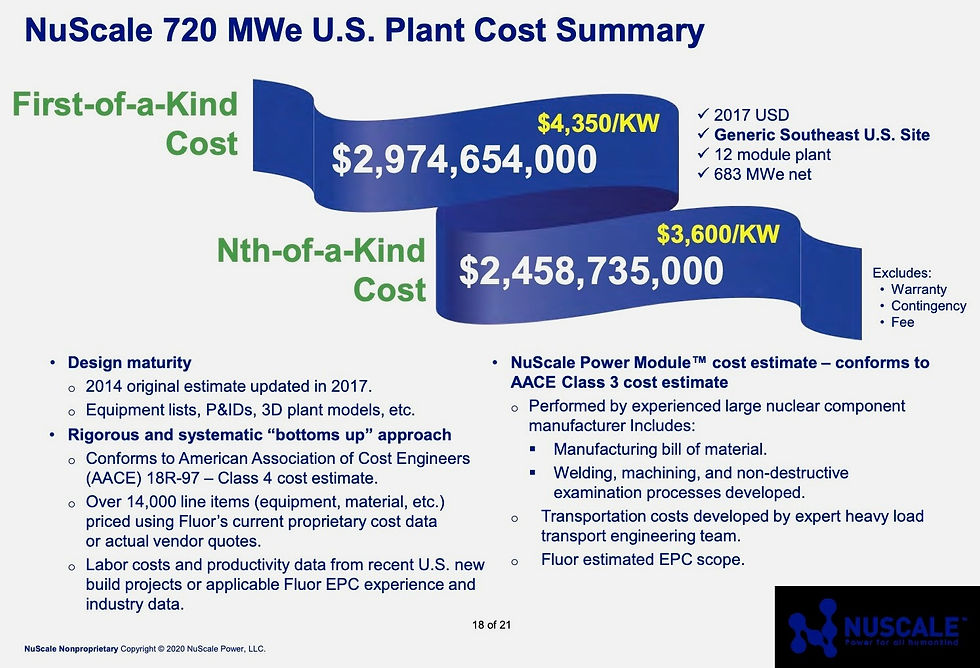

From 2017 until mid-2020 NuScale frequently presented versions of this slide:

Note that the US$3,600 figure is a NOAK estimate. As NuScale’s Thomas Mundy noted, at an AUD/USD exchange rate of 0.6859 this results in a cost estimate of A$5,248/kW.

The warranty, contingency and NuScale profit exclusions are noteworthy. These are amounts that would normally be included in an OCC.

It should also be noted that this estimate was released prior to the massive increase in costs disclosed to members in 2020 and is therefore no longer a useful reference.

Also noteworthy is that this is a very early estimate of NuScale’s 60 MW design, long before the Class 3 estimate of the 77 MW reactor module was completed.

This sounds very technical but the idea is to remove the time factor from the cost of the project. Consider how you might choose to pay for your new car. Do you get a load of cash together and buy that $30,000 vehicle outright? Or do you finance your purchase and pay a total of $36,000 for the same car, except it's spread over five years?

This is a very bad analogy for overnight cost.

The difference between total construction cost and OCC is the interest during construction — sometimes abbreviated as AFUDC, allowance for funds used during construction — not the cost of finance after construction.

The better analogy is a house building project. Say the construction contract is $600,000 and building takes three years. To keep it simple, assume equal annual payments to the builder paid at the start of each year and with interest accrued at the end of each year. At the end of three years you’d owe $688k:

Assuming you take out a 20 year mortgage, you could end up paying a total of something like $1.5m.

The OCC of the construction is $600k. The total construction cost (TCC) is $688k. (A full OCC would also include the cost of land, stamp duty, architect’s fee, permitting fees, etc.)

In the car analogy, the $6000 you paid in interest while enjoying your car is not equivalent to AFUDC, it’s the finance cost paid during ownership/operation. If you want to stick with that analogy, you’d need to deduct the manufacturer’s cost of working capital during manufacture, which is not something normal people have ever thought about.

Let’s take a look at Hinkley Point C — no, not to discuss cost and schedule overruns, but just to see an example of the difference between TCC and TPC. The figure below is from the UK’s National Audit Office 2017 report on the project.

According to the report, the TCC was expected to be £18.2bn (£18.4bn nominal). Language in the report suggests that this includes AFUDC, so the OCC would be less than that number.

The Total Project Cost was estimated at £54.8bn (£199.7bn nominal). In general the TPC is not as interesting as the TCC as the total project includes operational and end-of-life expenses and is also likely to be refinanced multiple times during the project life.

In the house example above, one could say that the TPC is $1.5m, if owning and living in the house was the project, or $688k if just building the house is the project. Always a good idea to nail down the definitions.

Of course, power stations are never paid for and built “overnight”, but the OCC provides a necessary baseline for costs without the complexities of timeframes and interest rates. When the extra costs of financing and the years of project construction, including overruns and everything, are added in for a given kW capacity (normally up to 300,000 kW, or 300 megawatts, for each small modular reactor), it gives us the “Total Project Cost”, a price tag figure invariably in the billions. So, before it collapsed, the 6 module, 462 MW Carbon Free Power Project had a reported price tag of USD$9,336,000,000. This figure, divided by 462,000 kW, would be $20,208/kW (almost AUD$30,000/kW) right? Wrong. Because this was the Total Project Cost, not the Overnight Capital Cost.

I think you’re right that CSIRO has mistakenly included AFUDC in their estimate for 2023 SMR (NuScale) estimate. As such their LCoE calculation is double counting AFUDC.

Is this material? Not really.

Let’s build a quick model using OCC of $31,138/kW. Using some simple assumptions (which are not guesstimates for illustration only, but probably not far off), AFUDC adds another $7,101/kW to the total cost.

Now let’s “goal seek” to work backwards from a total construction cost of $31,138/kW. Using the same assumptions we find OCC of $25,356/kW with AFUDC of $5,782/kW with a TCC totalling $31,138/kW.

Plugging those numbers into CSIRO’s LCoE calculation yields:

So by using TCC instead of OCC, all else remaining equal, CSIRO’s LCoE estimate for NuScale’s early-2023 costs is likely overstated by around 20%.

One problem: CSIRO’s LCoE calculations assume a three year build time for NuScale, whereas the company’s own schedules showed a five year build time (from 2026 to 2030 inclusive). Adjusting for this yields:

Ie. after backing out AFUDC and updating the build time, CSIRO’s LCoE estimate may be as little as 8% out.

I’ll level three other criticisms at CSIRO’s draft:

As discussed earlier, NuScale’s late-2023 cost estimates for the CFPP would likely be higher than their early-2023 costs, however it’s unlikely these costs will ever be in the public domain.

CSIRO presents $31,138/kW as a cost for starting construction in 2023. In reality NuScale prepared this price (in 2023$) based on construction starting in 2026. No CAPEX cost is available for construction starting in 2023.

CSIRO’s simple LCoE calculation formula assumes the full OCC is incurred on day one of construction, rather than a phased schedule of payments during construction. Here’s the formula for the annualised capital cost:

This likely results in a small overstatement of LCoE for projects with long construction periods.

Let me be clear: I do not think these issues are material. They can and should be addressed. Any errors are likely to be within acceptable error margins. The basic conclusions do not materially change.

It’s worth noting that any CSIRO errors here are of a much smaller magnitude than errors by WePlanet Australia in its blog post.

Why the focus on 2023 OCC?

It is not clear why advocates put so much focus on the 2023 cost estimate for SMRs. In 2023 all SMRs under consideration are pre-FOAK. We can fully expect these costs are ‘off the charts’, and it is simply not credible that Australia could have started last year and beat those costs.

The estimates for 2030 — approximately $15,900/kW under both scenarios — are much lower and seem quite fair.

The estimate for 2040 — $10,866/kW in the Global NZE by 2050 scenario — indicates a very steep learning curve. Given the history of nuclear build costs, a cost reduction of more than 30% over the course of a single decade would be a very strong result, especially in a country just getting started.

In short, the OCC that matters is 2040, not 2023 and the accidental inclusion of AFUDC is immaterial.

If you’ve followed this so far, you’ve apparently done better than some of the most respected Australian professionals working in this space.

Is this snark really justifiable given the relatively minor issues with CSIRO’s work, and the more significant issues with WePlanet Australia’s analysis?

The CSIRO has been supplying cost estimates for all energy technologies, including SMRs, since last decade in its GenCost publication. SMR estimates are still in there, despite calls to drop them,

To be fair, in January 2021 BNW suggested that CSIRO either drop SMRs or use the Canadian SMR Roadmap as a data source. (Oscar is listed as a reviewer on the linked submission from BNW.) Despite frequent claims by some advocates to the contrary, CSIRO took the second suggestion on board, and has referred to the Canadian SMR Roadmap starting from the June 2021 edition of GenCost.

and following the termination of NuScale Power’s first project a consultation draft and “explainer article” was released, reiterating that “Nuclear power does not currently provide an economically competitive solution in Australia” and that “updated costs for a key project in the US have been found to be very high.” How high? Around $31,000/kW, Australian dollars

Why did the CSIRO put the Total Project Cost on this chart?

CSIRO should have been consistent by using either the OCC or the TCC — preferably the OCC — but in reality the difference between the two is practically noise compared with the signal.

With respect, a balanced WePlanet Australia article would have noted just how wrong ‘the literature’ has turned out to be.

In a 2022 investor presentation, NuScale Power cited an Overnight Capital cost of USD$3.3 billion for their 924 MW 12 module power plant.

While that claim is made on a blog, the link to the presentation is dead. Do you have a copy? I haven’t seen NuScale make claims like that since before DCRA was signed in 2020.

This works out to USD$3,571/kW, or about $5,100 per kW in Aussie dollars. While it’s entirely fair to emphasise the fatal escalation of the total cost of the project, apples MUST be compared with apples, and from the COO’s 2019 letter we know that NuScale Power’s standardised cost estimates were already well advanced.

History has shown that NuScale’s 2019 cost estimates were not ‘well advanced’. I’m pretty sure they weren’t even Class 4 estimates at that point. As the project estimates moved to Class 4, and then Class 3, the costs escalated massively.

The USD$3,571/kW figure cannot be reconciled with the FOAK, and frankly NuScale’s public relations unit has repeatedly published figures that cannot be reconciled with the numbers that would have been on the desks of NuScale’s own engineers at the time. (I suspect this is not unusual for large companies.)

There is a long history of chronic underestimation of costs by nuclear PR departments. Only actual figures (where available) can be relied upon, and only then if the source is trustworthy and it’s totally clear what’s included and excluded.

They were compared with oranges instead. Why? How?

I suspect the apparent mix up of OCC and TCC was a mistake, but without asking CSIRO it is corrosive to the debate to imply bias or incompetence.

Maybe the CSIRO didn’t want to check, but can we? There’s a fleet of new SMRs planned for Ontario, Canada, with the first set for operation by late 2028. In this case it’s the BWRX-300 design offered by GE Hitachi. Poland intends to follow close behind in deploying these reactors, and the first unit’s initial CAPEX was reported to be €1.1 billion. In context, this roughly equals the Overnight Capital Cost, rather than any total cost of a project which isn’t even licensed yet. Converting to Australian and normalising by kilowatts gives AUD$6,100/kW. Pretty close.

Reports of the BWRX at €1.1bn are no longer credible. The cost of the first unit at Darlington was expected to be announced in September 2023, however it is not yet public. Officials have indicated that the cost might be announced in the second half of 2024 or sometime in 2025.

It is rumoured in industry circles that the BWRX has been subject to major design changes over the past two years. (The dimensions of the containment structure for the BWRX is now approaching those of the AP1000, for a much smaller power output.)

It is further rumoured that the FOAK cost is currently $12,000/kW. I don’t know if that’s a CAD or USD figure, but given the precision of the estimates, the distinction between those two currencies doesn’t really matter.

We really need to check that we’re not being too optimistic though. Can we do that against real, actual nuclear plant construction? Not with SMRs just yet. The closest we can probably get is that time when Westinghouse named their AUD price for a pair of AP1000 reactors: $19.8 billion, adjusted for inflation. For the 1,150 MW AP1000 this works out to an OCC of $9,230 per kW.

Using the RBA inflation calculator I get $21.85bn to 2023 — though, to be fair, construction costs don’t track CPI perfectly.

In the same breath, the Westinghouse representative claimed that “construction of the company’s AP1000 model would take four years”.

These very dated and informal cost and time estimates from Westinghouse — produced years before Vogtle was delivered — sound a lot more like PR than engineering estimates and carry very little weight.

How does this help us after so many years have passed? Well, in Australian dollars this number happens to be quite close to the "Next AP1000 (High end Estimate)" of $9,714/kW as reported in the 2022 MIT Overnight Capital Cost of the Next AP1000 report, which possibly makes sense if, hypothetically, this large reactor was chosen to be Australia’s debut in nuclear energy - joining Ukraine, Poland, Bulgaria and the Czech Republic, and potentially Finland, Sweden, and Holland. This report estimated that the OCC of Vogtle units 3 & 4 were USD$7,956/kW (AUD$11,370/kW). These two AP1000 reactors are now finally running at Plant Vogtle in Georgia, USA. After a tumultuous, delayed construction process the final cost - the Total Project Cost - is almost USD$35 billion. Converting to Australian and normalising by the 2,300 MW power station capacity works out as $21,740 per kW. Remember, this is the Total Project Cost, not the Overnight Capital Cost, and isn't useful for proper comparisons, but can certainly encourage confusion when quoted in error!

The OCC cost of Vogtle does not need to be guessed. We can see from the monthly Vogtle reporting that the construction cost of Georgia Power’s 45.7% share is forecast to end up at $11.629bn. That puts the total OCC at $25.446bn, or in unit terms, US$11,391/kW.

Including the $3.513bn for Georgia Power’s AFUDC, and scaling up from that 45.7% share again, we end up with a total construction cost of $33.1bn.

Note there is a difference between the $33.1bn calculated TCC and the $35bn TCC reported in the media. Maybe there are additional owner’s costs or a more complex capital structure or a delay in certain costs making it to the monthly reports. Or some combination of all three. Regardless, we’re in the ballpark.

By my calculations Vogtle’s TCC is 30% greater than its OCC. Vogtle’s AFUDC was pushed down by government supported favourable financing and advanced cost recovery (ie. pushing some project costs on to ratepayers during construction). On the contrary, Vogtle’s AFUDC was pushed up by the project construction delays.

Regardless, unless the cost of capital is very high and the project timeline blows out massively, TCC costs should never be multiples of OCC.

Why the focus on OCC?

I asked earlier about the focus on the 2023 OCC. I also think it’s worth questioning the obsessive focus on OCC in general.

Just as LCoE is an imperfect measure, so is OCC. Both are useful, especially for comparing projects of the same technology but the OCC on its own (by definition) excludes the cost of capital (likely higher for high risk projects) and the build time. These both drive AFUDC.

Would-be project owners care much more about the TCC (and construction time) than the OCC.

Could Australia get a better price for large reactors (like all those European countries possibly are)?

There are not yet reliable indications that new reactors in Europe will be built at a lower cost.

Could SMRs really be delivered at the optimistic Overnight Capital Costs quoted above? While this deserves far better analysis than it has received so far from the CSIRO, improving the certainty of these numbers isn't actually the first step

CSIRO has done a fine job given the paucity of information. The most reliable costs in the public domain come from NuScale and are far higher than the costs quoted in academic studies, investor presentations, marketing brochures and advocacy reports.

There is little CSIRO can do to improve the certainty of the number until the first transparent project is substantially complete.

- the first step is lifting the prohibition on nuclear energy. Obviously, vendors won't engage in the region-specific work and cost estimation until their products are at least legal (just like they wouldn't bother trying to sell designs at over $30,000/kW). But until then, we can at least try not to confuse ourselves with numbers which can't be meaningfully compared.

Any feasibility that proceeds through the many stages from ideation to realisation goes through a series of ever more detailed cost estimates. Early cost estimates can easily draw data from countries with similar construction environments, and would be adjusted for differing labour costs and practices, raw material costs and supply chain maturity. A suitably qualified engineering firm with experience delivering large infrastructure projects in Australia and other comparable countries would be perfectly capable of producing a high level cost estimate based on detailed project data for a completed build.

No project proponent would proceed to a 7-figure cost estimate phase without having first commissioned a desktop study. Plenty of industries have developed detailed business plans in Australia prior to legislative blockers being addressed, in fact that’s a critical step in any effective industrial advocacy.

My personal opinion is that the ban is a distraction and you’re not doing the real work that lies on the critical path to developing a local nuclear power industry.

Summary:

This chart should indicate the year of construction start these costs are for.

(in equivalent AUD) | estimated Overnight Capital Cost $/kW | Total Construction Cost $/kW | Comments |

NuScale (CFPP) | $5,100 | $28,868 | The total construction cost is at least US$9.336bn or US$21,915/kW — ie. A$31,308/kW at 0.7 AUD-USD rate.

The Estimated OCC is probably in the vicinity of A$25,494/kW, meaning the one given here is out by a factor of perhaps 500%. |

BWRX-300 | $6,100 | TBA | We don’t know the OCC for the BWRX-300, but it’s likely to be much higher than $6,100/kW. Possibly double if rumours are correct. |

AP1000 in the US | $11,366 | $21,740 | If we use Vogtle numbers (OCC A$16,300/kW, TCC A$21,700/kW), this OCC is out by a factor of 30%, the TCC is about right). We don’t know the cost of the next AP1000. Hopefully much lower, or there’ll never be another one built. I am optimistic based on multiple factors, but that optimism doesn't lead to a price. This should be clear here. |

AP1000 in Aust. | $9,231 | TBA? | We have no idea what the cost of an AP1000 would be in Australia, but there’s no reason to believe it’d be cheaper than the US. To the contrary, it’s likely to be more expensive. |

CSIRO GenCost | ̶$̶3̶1̶,̶0̶0̶0̶ | $31,000 |

Footnotes: – AEMO commissioned GHD for a set of overnight capital cost estimates in 2018, including a fictional non-light water SMR (page 88), which was applied by GenCost to generic SMRs

I don’t think that claim holds true from 2021 onwards. (I also suspect that GHD thought that light-water SMRs were to be designated as GenIV and didn’t mean to imply a non-light water SMR was the subject of their analysis.)

– The CSIRO excludes analysis of conventional large reactors; an explanation was recently offered here – The “prevailing exchange rate” is set at 0.7 USD, consistent with GenCost (page 16) Further reading: • IEA OECD-NEA Projected Costs of Generating Electricity • Canadian SMR Roadmap • Ben Heard – Small modular reactors in the Australian context • Stephen Wilson – What would be required for nuclear energy plants to be operating in Australia from the 2030s?

On the whole, I believe this obsession with OCC is bizarre. Yes, you want to take care to ensure that all the inputs to an LCoE calculation are credible, but it should be noted that the TCC (and LCoE) are far more important than the OCC.

But hey, what would I know?

Note: Nuclear costs are high, frustratingly so. Like many I wish these costs would come down significantly so that the technology can help rapidly decarbonise grids around the world. For some, this frustration unfortunately manifests as accusations of bias, incompetence or disingenuity.

Some bad faith actors — I’m not talking about WePlanet — will be inclined to cherry-pick comments in this report to say “see, even Simon Holmes à Court says CSIRO made mistakes”. I reiterate for their benefit:

I do not think these issues are material. They can and should be addressed. Any errors are likely to be within acceptable error margins. The basic conclusions do not materially change.

It’s worth noting that any CSIRO errors here are of a much smaller magnitude than errors in WePlanet Australia’s critical blog post.

Note that it’s very possible that I have made mistakes in this note. I welcome corrections.

I ask that this note accompany any quotes of my comments in this report.